By Francesco Caruso, MFTA, Global Asset Strategy Amber SICAV advisor

The great surprise that emerges from these first two months of 2018 is that the markets are not invulnerable. If we make a quick balance, we see that virtually all asset classes have had a negative return, apart from some equity markets: Italy, USA, BRIC (Brazil and Russia “best of best”) and Emerging. As always, the numerous army of hindsight gave explanations of all kinds to the violent correction of February. Yes, it goes from fears of further increases in US interest rates – as if this were a surprise or something not announced for at least a year – to presumed interventions of speculative forces, which emerge only when there is some negative movement to explain.

We would like to limit ourselves in this brief analysis to the facts. The first fact is that during the very quick correction in February (10 sessions), billions of Euros of products that were based on the short sale of volatility were literally swept away with no return. The Windsellers have discovered that from time to time the wind goes against them. But they started again, which means that the lesson was not enough.

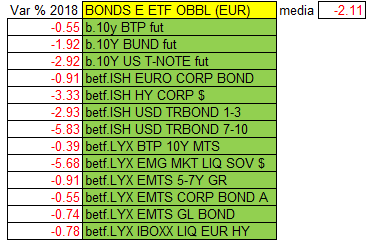

The second fact is a very simple assessment: about 75% of global assets are invested in bonds which – due to the tensions on interest rates and various other considerations related to credit risk – have fallen quite sharply (much more than the stock exchanges on average) and created losses.

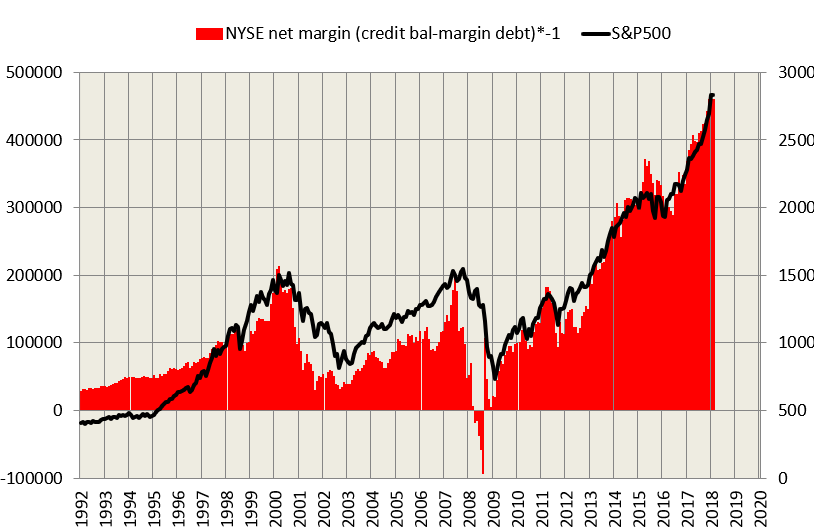

The third consideration is that the leverage, namely the net debt, what we might call the speculative part of the market (where speculative does not mean a negative sense but simply a realistic sense of the term), is currently more than double than it was on the highs of 2000 and 2007 (less if it relates to the GDP: but always very high).

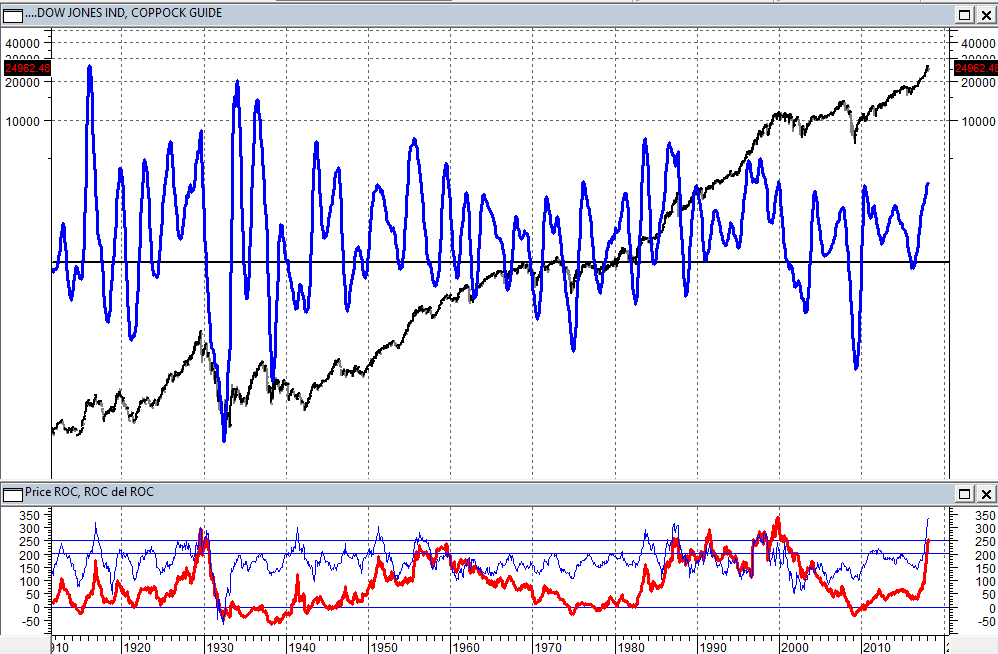

The fourth consideration is that the US stock market is currently pricing not only a growing economy but also growing margins. Is the US stock market right? On many objective parameters, it is at one of the highest overvaluation levels in its history, now only comparable to that recorded in the final part of the Bull Market 1991-2000.

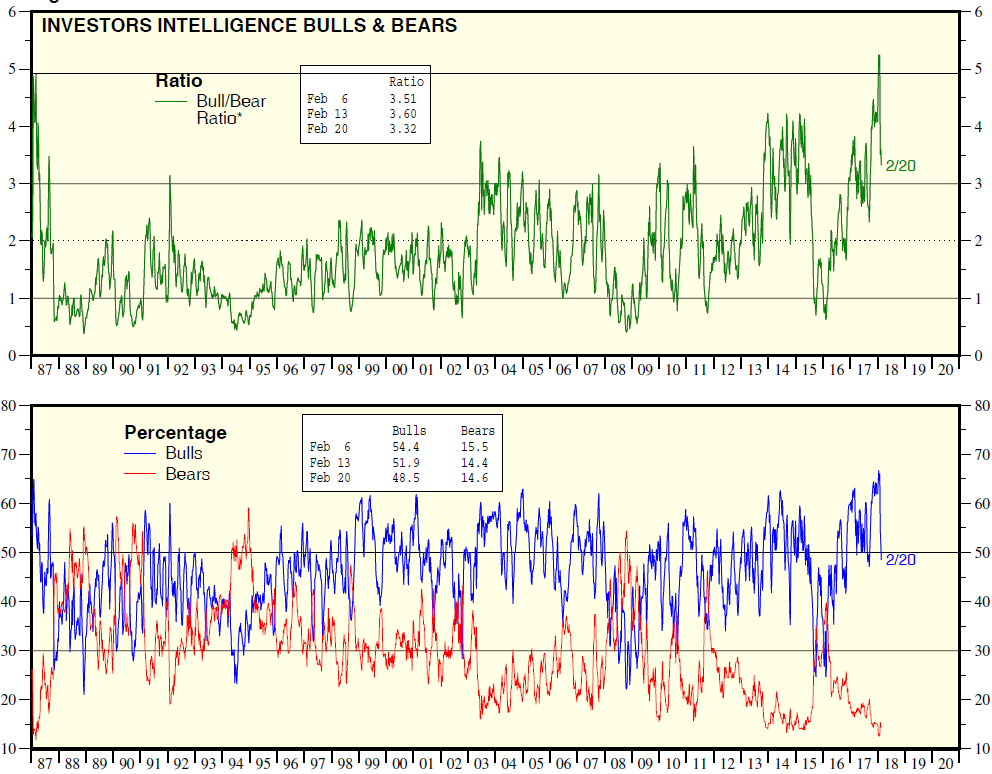

The fifth consideration is linked to a concept that is apparently not quantifiable as complacency, but in reality, measurable through certain parameters such as that of the Ratio Bull Bear, which reached its historical maximum in the days of the highs.

The question we must ask ourselves right now is: what do these five points have in common? The shared element is given by what has happened in recent years, that is, the huge amount of money that has been poured into the markets and that has created this kind of monster represented by markets that no longer know any other law except that of the “buy” the dip (Watch the illuminating video below) and the everlasting ascent.

The markets are made by individuals. After the 2008 crisis, a new way of seeing and experiencing the markets was established, which in fact was only confronted with an uptrend market or with a market strongly supported by central banks. The learning cycle made by the alternation of negative phases and positive phases has disappeared: if ones eliminate the negative one it is no longer learning but it is counter-information.

The question that must be addressed – at least from an intellectual point of view – is quite simple: is this a situation that has become so rooted in the markets that it is part of the new DNA cleverly grafted by central banks, or is simply a drift of the greed and complacency that in fact characterize all the big market tops?

Although apparently this is a purely theoretical issue, in the sense that in fact what matters is to gain, in reality it is not. If the answer to this question was that of the first hypothesis, namely de facto controlled markets in their development, we would now be in an era of socialization of returns, that is, returns that in fact become almost automatically provided by the markets compared to a very trivial allocation structures.

If the answer was the second – that we are facing a prolonged anomaly derived from the extraordinary sequence that took place from 2008 onwards – then the correct consequent question is: what could happen from now on? We will see in the coming months how markets will surprise us and how central banks will be surprised. Meanwhile, should we have to pick something to position ourselves from now until the spring (beyond we cannot go…), we undoubtedly pick the Emerging markets and the BRICs: hoping that pro-Europeans who are unfortunately biting the dust of the underperformance since many years don’t hold it against us.